Health Insurance Buying Guide: Compare the Best Health Insurers in New Zealand

Compare health insurance plans from New Zealand's best insurers. Get a FREE comparison of hospital plans from nib, Accuro, Southern Cross, Partners Life & AIA.

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required

Thinking of buying health insurance but you’re not sure which plan to get?

This guide details what you need to know when comparing health insurance plans. Learn about common inclusions and exclusions, plus tips on how to get lower premiums, switch plans and file claims. Know about the medical plans offered by New Zealand’s best health insurance companies: nib, Accuro. Southern Cross, Partners Life, and AIA.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

nib | Accuro | Southern Cross | Partners Life | AIA

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Looking for hospital cover? Compare health insurance plans instantly with our FREE hospital cover comparison table. If you want to speak to someone directly, book a call with one of our friendly Policywise specialists.

Do You Really Need Private Health Insurance in New Zealand?

New Zealand has a comprehensive public health system. Public healthcare generally covers treatment for acute conditions and injuries from accidents, subsidised general practitioner (GP) visits and prescriptions, and, for children under 14 years old, free GP consultations.

However, many New Zealanders still face healthcare challenges, especially in getting fast medical attention for chronic conditions. Due to increasing demand, many Kiwis have had to wait several months to a few years to have elective surgeries in public hospitals.

These long waiting times can have negative consequences on patients’ health and quality of life before and after their treatment. As a result, many Kiwi patients may try to go to private hospitals to have their procedures done sooner, especially if their condition is causing them debilitating pain.

New Zealand also lags behind in terms of public funding for modern medicines. A global study published in May 2020 found that public funding was available for only 24 out of the 403 modern medicines introduced in the Organisation for Economic Co-operation and Development (OECD) between 2011 and 2018.

Because of this, some Kiwi patients take out loans or mortgages, rely on fundraisers, deplete their emergency savings and retirement funds, or find other ways to be able to afford non-PHARMAC funded drugs and treatments.

Benefits of Private Health Insurance

Private health insurance broadens your healthcare access and options, empowering you to choose where to get treated and what medications to use.

As of June 2021, more than 34% of New Zealand adults reported having private health insurance coverage and access to its benefits, including:

- Shorter wait times. Having health insurance gives you the option to go to private hospitals for tests, consultations and treatments without worrying about the costs. Skipping long waiting times also means you can be free from the pain or discomfort caused by your health condition as soon as possible.

- You no longer have to put your life on hold. You can recover faster and go back to work or resume your hobbies sooner.

- Coverage for non-PHARMAC funded drugs. Depending on your coverage and health condition, your insurer may shoulder the cost of non-PHARMAC-funded drugs for treating cancer and other diseases.

- Access to better treatment options and facilities. Having health insurance gives you access to high-quality facilities at private hospitals, from the latest technology and equipment to better rooms and beds for patients.

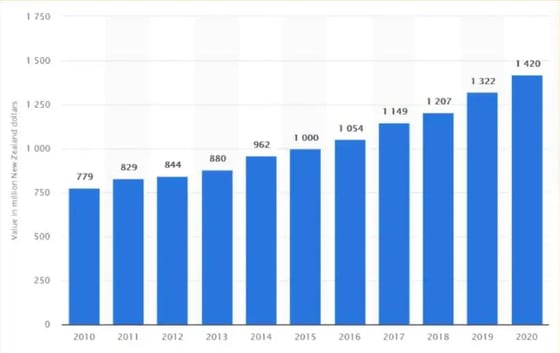

Source: Thomas Hinton (March 25, 2021). Retrieved April 2, 2022, from https://www.statista.com/statistics/1051074/new-zealand-health-insurance-claims-paid.

- Peace of mind. Having health insurance gives you greater assurance that you have the resources to afford life-saving or life-extending treatment if you or your loved one needs it.

- More control. Private health insurance gives patients more control over their treatment. You have more options in terms of which physicians to see, where to get your surgery, or to try Medsafe-approved drugs that aren’t funded by PHARMAC.

Private Health Insurance Coverage and Inclusions

Kiwi residents can get private health insurance for themselves, their partners, families and employees.

But it’s important to note that these private health insurance plans can vary greatly in terms of benefits. Plans may cover just day-to-day health benefits or major expenses such as hospitalisation and surgery. Other plans offer comprehensive insurance, combining the benefits of everyday plans and hospital cover.

Below are some of the healthcare costs covered by insurance. Keep in mind that this is not an exhaustive list, and coverage will vary depending on your health insurance plan. Some insurers may include these benefits in their base plans, while others offer these as add-ons.

Major Policies/Hospital Cover for major healthcare costs such as:

- Cancer diagnosis, treatment, follow-up consultations, travel and accommodation

- Non-PHARMAC funded Medsafe medication cover

- Specialist consultations

- Diagnostics like x-rays, MRI exams, PET scans and CT angiograms

- In-hospital medical treatment costs such as accommodation, ECG and prescriptions

- Surgeries such as melanoma surgery and hip and knee replacements

- Non-surgical costs like allergy treatment

- Overseas treatment, if needed

Minor Medical Expenses/Day-to-Day Treatments including:

- GP consultations

- Dental check-ups and treatments like cleaning, fillings, extractions, root canal therapy, crowns, dentures, and endodontic and orthodontic treatments

- Pharmaceutical prescriptions

- Mental health services (psychologist or psychiatrist consultations)

- Allied and therapeutic care such as physiotherapy, chiropractic, acupuncture and traditional Chinese medicine

- Vaccinations

Comprehensive Plans:

- Combine the benefits of minor and major health insurance plans

Choosing the Appropriate Cover: Identifying What Matters

The type of coverage appropriate for you and your loved ones will depend on your circumstances and financial capacity. But here are a few essential coverages you may need to consider.

- Cancer Cover

Cancer cases continue to rise in New Zealand, and cancer-related diseases have become the leading cause of death in New Zealand. According to Health New Zealand, the number of new cancer registrants in 2022 reached over 28,000, while the number of cancer-related deaths was more than 10,500.

While cancer treatments are available, their prices are often steep. According to nib, chemotherapy and radiotherapy in private facilities can cost $15,000–$170,000 and $20,000–$55,000, respectively.

- Non-PHARMAC Cover

New Medsafe-approved treatments are available for a number of diseases, but many of these are not yet publicly funded. Health insurance plans with non-PHARMAC cover can help patients pay for these treatments.

- Hospital/Surgical Cover

This benefit covers in-hospital and surgery-related services such as hospital accommodation and required supplies, prescriptions, diagnostic exams and post-treatment care.

This benefit becomes crucial when patients need elective surgery and would like to avoid long wait times at public health facilities.

- Non-surgical Treatment

Not all illnesses can be treated with surgery. When choosing a plan, ask about non-surgical benefits such as allergy treatments and IV infusions.

- Diagnostic Procedures

Check the types of tests and amounts your preferred plan will cover for diagnostic procedures such as x-rays, MRI exams, CT scans, and PET scans.

When choosing a plan, you must understand what’s covered and what’s excluded in your health insurance policy. Contact us if you need help determining the best insurance plan for your needs.

Exclusions

Below are some procedures and conditions that are often excluded in health insurance policies:

- Organ transplants

- HIV/AIDS

- Dementia

- Cosmetic treatment

- Self-inflicted injuries

- Assisted reproduction

- Health conditions brought about by substance abuse

- Chronic conditions like asthma and arthritis, and other pre-existing conditions

Be sure to ask your Policywise adviser about these exclusions and read your insurance plan’s fine print.

Pre-existing Conditions

Pre-existing conditions refer to health conditions, symptoms and injuries you already have before you buy your health insurance plan.

Some health insurers will cover pre-existing conditions after a specific number of years. But many of them will never cover the following:

- Cancer (although companies like nib may still provide cover for pre-malignant, pre-existing cancers if the patient has been treated by a registered specialist)

- Cardiovascular conditions

- Hip or knee conditions

- Transplant surgery

Since younger adults are generally healthier, it’s best to get health insurance while you’re young and are less likely to have pre-existing conditions that can limit your cover.

Contact Policywise if you need help with health insurance exclusions and pre-existing conditions. Our advisers are trained to negotiate with your chosen provider for the lowest number of exclusions. If you have pre-existing conditions, Policywise can help you find the best health insurance plan for your medical circumstances.

How Much Health Insurance Do You Need?

Insurance plans have differing maximum claim amounts per policy year. Higher limits may be beneficial for conditions like cancer, but are not as necessary for other health conditions and procedures.

To give you an idea of how much health insurance you actually need, check out the data below on private healthcare costs with no insurance coverage.

Cancer Treatments & Non-PHARMAC Funded Drugs |

Cost (NZD) |

Chemotherapy

|

Over $1 million/year $1.2 million/year $72,000/year |

Immunotherapy

|

$1.4 million/year $150,000 for four doses Around $8,000/dose, taken every three weeks; capped at $60,000 under the manufacturer’s cost-share program |

Onasemnogene abeparvovec-xioi (Zolgensma; for spinal muscular atrophy) |

$3.1 million/dose |

Lonafarnib (Zokinvy; for Hutchinson-Gilford progeria syndrome) |

$1.5 million/year |

Nusinersen (Spinraza; for spinal muscular atrophy) |

$1.16 million/year plus one injection every four months (about $125,000 per injection) |

Elexacaftor/tezacaftor/ivacaftor (Trikafta; for cystic fibrosis) |

Close to $500,000/year |

Up to $200,000 |

|

Metastatic melanoma treatment |

Up to $200,000 |

Targeted therapy

|

$132,000/year |

Radiotherapy |

Up to $60,000 |

Hospital Treatments |

Cost (NZD) |

Radical neck dissection |

Up to $170,000 |

Spinal surgery |

Up to $150,000 |

Mastectomy with breast reconstruction |

Up to $100,000 |

Coronary artery bypass and valve replacement |

Up to $110,000 |

Bowel resection |

Up to $60,000 |

Hip replacement |

Up to $40,000 |

Robotic prostatectomy |

Up to $35,000 |

Sinus surgery |

Up to $33,500 |

Total knee joint replacement |

Up to $28,000 |

Up to $25,000 |

|

Varicose veins treatment |

Up to $10,500 |

Wisdom teeth extraction |

Up to $5,800 |

Cataract surgery |

Up to $5,000 |

Grommet insertion |

Up to $3,500 |

Diagnostic Tests & Outpatient Treatments |

Cost (NZD) |

Up to $3,300 |

|

PET scan |

Up to $3,500 |

MRI scan |

Up to $3,000 |

CT scan |

Up to $2,100 |

Ultrasound |

Up to $1,500 |

GP minor surgery |

Up to $400 |

Specialist consultation |

Up to $280 |

Everyday Treatment |

Cost (NZD) |

Dental |

Up to $400 |

Optical |

Up to $400 |

Mental health consultations |

Up to $255 |

Acupuncture |

Up to $80 |

Physiotherapy |

Up to $70 |

GP consultations |

Up to $60 |

How Much Do Health Insurance Premiums Cost?

Several factors can affect the cost of your premiums. These include:

- Age: Premium costs increase as you age.

- Gender: For example, in early adulthood, women pay higher premiums than men who share the same age and health status.

- Smoking status (cigarette smoking and vaping)

- Body mass index (BMI): A high BMI may indicate greater health risks, thereby increasing your premium.

- Certain pre-existing conditions

- Level of cover

- Paying an excess: Health insurance excess is the amount you pay when making a claim. For example, if you choose an excess of $500 and make a claim for a surgery costing $5,000, you will pay $500 and your insurer will pay $4,500. With some plans or insurers, you only have to pay excess once or twice per year.

- Number of dependents included in your policy

- Increasing cost of claims due to medical advancements and inflation

- Frequency of payment: Annual premiums cost less than fortnightly or monthly premiums.

Below are sample quotes for comprehensive hospital plans of Accuro, AIA, nib, Partners Life, and Southern Cross with a $500 excess.

| Fortnightly premiums ($500 excess) | |||||

|

30-year-old female (non-smoker) |

$37.88 |

$55.28 |

$65.41 |

$47.28 |

$34.95 |

|

30-year-old male (non-smoker) |

$37.88 |

$47.52 |

$54.57 |

$39.17 |

$34.95 |

|

40-year-old female (non-smoker) |

$48.54 |

$64.37 |

$70.27 |

$53.75 |

$50.31 |

|

40-year-old male (non-smoker) |

$48.54 |

$57.53 |

$59.05 |

$46.23 |

$50.31 |

|

50-year-old female (non-smoker) |

$80.38 |

$97.23 |

$112.05 |

$80.62 |

$85.82 |

|

50-year-old male (non-smoker) |

$80.38 |

$91.42 |

$100.09 |

$72.77 |

$85.82 |

Contact us today to get your FREE, no-obligation health insurance quote.

How to Get Lower Health Insurance Premiums

Below are some ways to lower your premiums or get a deduction:

- Increase your excess

Opting for a plan with a higher excess can lower your premium costs. - Get the right add-ons that fit your personal situation

This helps you avoid paying for extra cover that you don’t really need. - Maintain a healthy lifestyle

In general, smokers have higher premiums than non-smokers. - Consider your payment method

Some insurers offer price reductions to clients who make direct debit payments or annual premium payments. Ask your adviser if your chosen insurer offers this benefit.

Experienced Policywise advisers can help you get the most appropriate, cost-effective health plan for your needs. Contact us to request a quote.

Comparing New Zealand’s Best Health Insurance Providers

Below are the top-rated health insurance companies in New Zealand and an overview of their plans.

Nib New Zealand is part of nib Group, which specialises in health and medical insurance for Australian and New Zealand residents.

Policywise offers the following nib individual and family plans:

- Easy Health covers surgery, non-surgical/hospital medical benefits, cancer treatment and follow-ups, post-hospital home nursing care, ACC top-up, specialist consultations, diagnostic exams, public hospital cash grant, overseas treatment, non-PHARMAC funded chemotherapy drugs, and more. Optional add-ons include serious condition lump sum and additional non-PHARMAC cover.

- Ultimate Health is a more extensive plan than Easy Health and has higher coverage limits (up to $600,000 per policy year for surgical benefits and up to $300,000 for non-surgical benefits). Ultimate Health also has more optional add-ons, like GP, dental, and optical cover.

- Ultimate Health Max is nib’s most comprehensive plan. It has the same base benefits and add-ons as Ultimate Health, plus cardiac and cancer counselling and support services and hospice care. It also offers much higher non-PHARMAC drug cover up to $600,000. This policy also has an option to increase cover for non-PHARMAC funded drugs.

Aside from individual plans, nib also offers health insurance plans for businesses. The comprehensive base plan includes hospital surgical and non-surgical costs, diagnostic tests, and cancer treatment. Employers and employees can opt for add-ons like non-PHARMAC cover, serious condition lump sum, and dental and optical cover.

Accuro

Accuro is a not-for-profit health insurance cooperative offering health insurance plans for:

- New Zealand citizens and permanent residents

- Work visa holders who are staying in the country for less than two years

- Babies and kids

- Small, medium and large businesses

Accuro’s health insurance plans primarily include hospital and surgery cover. Everyday costs like dental plans and GP consultations can be included as add-ons.

INDIVIDUAL PLANS

- SmartCare, which covers general and oral surgery, major diagnostic procedures and private hospital admission

- SmartCare+: In addition to the benefits under SmartCare, this plan also covers non-PHARMAC drugs (up to $500,000 per policy year) and has higher cover limits (i.e., up to $500,000 for general surgery, $300,000 for oral surgery, and $300,000 for private hospitalisation and cancer treatment).

PLAN FOR BABIES AND CHILDREN

- KidSmart’s base plan includes cover for general and oral surgery, major diagnostic procedure, private hospital admission, and non-PHARMAC drugs

PLAN FOR VISITORS AND WORK VISA HOLDERS STAYING FOR LESS THAN TWO YEARS

- SmartStay includes cover for general and oral surgery, private and public hospital admission, major diagnostic procedures, minor surgery and reimbursement for overseas treatment

BUSINESS PLANS

Accuro offers the following:

- StaffCare, a hospital and surgical package with add-ons including specialist and GP cover

- StaffCare+: StaffCare benefits plus non-PHARMAC funded chemotherapy and higher benefit limits per policy

Southern Cross

![]()

Southern Cross offers health plans for individuals, families and businesses.

The not-for-profit insurer has a variety of individual plans, such as:

- Wellbeing Starter, which covers cancer care, specialist consultations, diagnostic imaging, surgical treatment, GP visits, and tests and recovery after surgery, chemotherapy or radiotherapy

- Wellbeing 1 includes broader benefits than Wellbeing Starter and provides cover for non-PHARMAC funded chemotherapy drugs. Clients can also add cover for optical, dental, and natural care services

- Wellbeing 2 shares similar benefits to Wellbeing 1, but offers a more comprehensive surgical cover

- UltraCare is a comprehensive plan that includes Wellbeing 2 benefits plus some day-to-day health services like GP visits and chiropractor consultations

- UltraCare policyholders who want to expand their dental and optical cover can upgrade to UltraCare400

- HealthEssentials for day-to-day health cover for GP, dental and optical visits

- RegularCare and KiwiCare are shared cover plans wherein both the policy owner and Southern Cross shoulder expenses for cancer care, surgery, and other medical expenses

Depending on your plan, you may have the option to add Cancer Assist (a one-off payment after a qualifying cancer diagnosis), Critical Illness, and Cancer Cover Plus (for additional chemotherapy for cancer and non-PHARMAC funded chemotherapy drugs).

Partners Life

![]()

Partners Life’s health insurance plans for families and businesses include:

- Private Medical Cover that includes hospital surgical benefits (up to $600,000 per policy year), hospital non-surgical benefits (up to $500,000), cancer care, non-Pharmac drugs, and mental health consultations

- Specific Condition Cover and Hospital Cash Cover: These plans pay a specific amount when the insured experiences a particular health event or needs treatment.

AIA

AIA’s individual health insurance products include:

- Private Health covers surgery, hospitalisation (up to $500,000 per policy year), cancer treatment (up to $500,000), consultations with specialists and mental health professionals, diagnostic tests, and overseas treatment.

- Cancer Care covers the cost of diagnostics, treatment (both PHARMAC and non-PHARMAC funded drugs), recovery and overseas treatment.

Changing Health Insurance Companies and Plans

Be sure to consider the implications before switching to a different insurer or plan. For example, if you have pre-existing conditions, these may not be covered (or may have conditions) in your new plan. It’s important to clarify these exclusions with your insurer or health insurance adviser.

Contact Policywise if you need more information and guidance on changing insurers or plans. They can help you weigh the benefits and trade-offs of cancelling your current policy and taking out a new one.

Easiest Way to Compare Health Insurance Online

When you’re unfamiliar with health insurance, understanding the terms, benefits, inclusions and exclusions on your own can be overwhelming.

What makes the choice even more difficult is that health insurance plans come in different packages. This makes comparisons more confusing.

A Policywise adviser can simplify the comparisons for you.

- They help you identify what benefits match your circumstances and the coverage you are more likely to need. If you have specific health concerns, health insurance advisers can help you identify which plans and insurers can provide you with the best cover.

- They give you quotes on different packages from multiple health insurers. This process focuses on the packages most relevant to your needs. You can easily see differences in benefits and prices, and choose the plan and provider that gives you the most appropriate cover for the lowest price.

- They can negotiate exclusions and loading on your behalf. Premium loading refers to an extra amount some insurers charge applicants that are considered higher risk.

- Advisers can help you understand the details of your plan, including:

- excluded medical conditions and procedures

- insurers’ policies on pre-existing conditions

- yearly limits on hospitalisation, diagnostic procedures, surgeries, cancer care and other benefits

- coverage for PHARMAC and non-PHARMAC funded drugs

- coverage for post-operative treatments and care

- coverage for dependents, including children

- coverage for procedures that do not require hospitalisation

- ways to get lower premiums

- Advisers provide ongoing support. They can help you process and negotiate your claims. Advisers can also coordinate with insurers about changes that affect your policy, such as having exclusions removed or adding your new baby to your plan, and they can negotiate lower premiums if you quit smoking.

How to Make a Claim

Do you want an easy, effortless way to file claims? Let Policywise’s insurance experts do the heavy lifting and file and negotiate claims on your behalf.

If you prefer to file claims on your own, we’ve outlined the general steps below. Be sure to check these with your insurer, in case they have other requirements for making claims. Some insurers may also advise you to download their app to submit your claim online.

1. Go to your GP

Visit a general practitioner who is registered with the Medical Council of New Zealand. If they advise you to see a specialist, ask if they have a recommended clinic or specialist. You can also ask for an open referral, so your health insurer can select a specialist or private hospital for you.

2. Check which providers your health insurer offers full coverage for

Some insurers offer full coverage only if you go to their affiliated health providers. Be sure to check with your insurer if this is one of their requirements for making a claim.

3. Apply for pre-approval

Once you know what consultations, tests and procedures you’ll need, ask your insurer about the benefit limits for each and apply for pre-approval.

Securing pre-approval can help you better plan and prepare for your treatment. It gives you the assurance that your claims will be processed and/or you will be reimbursed for healthcare costs. It also allows you to prepare financially in case part of the costs are not covered by your insurance plan.

4. Confirm how your insurer will cover your medical expenses (within benefit limits)

Your health insurer covers the medical cost. Depending on the health insurance plan you have, this may include consultations, procedures, medications and post-recovery expenses. Your insurer will either pay the healthcare provider directly or reimburse your medical expenses.

If you opted for an excess or a cost-sharing plan, you will be paying for part of the medical bill.

Is Private Health Insurance in NZ Worth It?

Private health insurance is a smart and worthwhile investment to protect you and your loved ones’ health and finances in the event of illness requiring costly treatment. The premiums you pay entitle you to benefits that could otherwise cost hundreds of thousands of dollars each year. Health insurance gives you the assurance that costs and long waiting times will not prevent you or your loved ones from getting life-saving or life-extending treatment.

Disclaimer: All information on this page or website is general information only, not intended as advice, and does not take into consideration your personal circumstances. We recommend consulting a Policywise adviser before making any insurance decision.

Please note: Policywise advisers are licensed by the Financial Markets Authority to provide financial advice in relation to health insurance, life insurance, and disability insurance. You can learn more about this on our Public Disclosure page. All insurance covers are subject to the insurer’s approval of your application.

Insurance policies and their built-in and optional benefits may be subject to stand-down periods, exclusions, terms and conditions, and premium loadings not listed on this website. Optional benefits also have additional premiums. Please refer to the insurance product’s policy document for full details. Insurers may alter these details at any time.

Therefore, nothing in our product pages is intended to be definitive or binding. Where there are discrepancies between any policy wording on this website and the policy wording provided by the insurance company at the time your cover is approved, then the insurance company’s wording will be deemed the correct version.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which health or life insurance is best for you.

References

-

“AIA Health: Health Insurance.” 2020. AIA. https://www.aia.co.nz/content/dam/nz/en/docs/our-products/brochures/aia-health-insurance.pdf

-

Akoorie, N. “Pharmac Won't Fund Spinal Muscular Atrophy Spinraza.” The New Zealand Herald, April 24, 2020. https://www.nzherald.co.nz/nz/pharmac-wont-fund-drug-spinraza-to-help-children-with-spinal-muscular-atrophy/T4XLXGYTSFR2SQLYGT4M2TTHCI/

-

“Bad Backs Top List of Most Expensive Health Insurance Claims.” Radio New Zealand, October 3, 2021. https://www.rnz.co.nz/news/national/452807/bad-backs-top-list-of-most-expensive-health-insurance-claims.

-

Blommerde, C. “Family's $50,000 Cost for Dad's Life-Extending Bowel Cancer Medicine.” Stuff, September 17, 2020. https://www.stuff.co.nz/national/health/122796033/familys-50000-cost-for-dads-lifeextending-bowel-cancer-medicine

-

“Cancer data web tool.” Health New Zealand Te Whatu Ora, December 12, 2024. https://tewhatuora.shinyapps.io/cancer-web-tool/

-

“Dire Findings – NZ Continues to Rank Last for Modern Medicines Access.” Medicines New Zealand, June 15, 2020. https://www.medicinesnz.co.nz/resources/media-releases/media-releases-single/dire-findings-nz-continues-to-rank-last-for-modern-medicines-access

-

Goodwin, E. “Melanoma Drugs Come at a Cost.” Otago Daily Times, April 30, 2015. https://www.odt.co.nz/news/dunedin/melanoma-drugs-come-cost

-

“Health Insurance.” 2021. nib. https://www.nib.co.nz/health-insurance

-

Hinton, T. “Value of Claims Paid by Health Insurers in New Zealand from Financial Year 2010 to 2020.” Statista, March 25, 2021. https://www.statista.com/statistics/1051074/new-zealand-health-insurance-claims-paid/

-

Lewis, O. “$22k Surgery, or Months of Pain: Public Surgery Wait Times Prompt Patients in Agony to Go Private.” Stuff, October 22, 2019. https://www.stuff.co.nz/national/health/116738965/public-surgery-wait-times-prompt-patients-in-agony-to-go-private

-

McQueen, H. “The 10 Most Expensive Drugs in the US, Period.” GoodRx, September 7, 2021. https://www.goodrx.com/healthcare-access/drug-cost-and-savings/most-expensive-drugs-period

-

Munro, B. “Bruce Munro: Disgraceful Waiting List for Elective Surgeries at Public Hospitals.” The New Zealand Herald, January 18, 2021. https://www.nzherald.co.nz/nz/bruce-munro-disgraceful-waiting-list-for-elective-surgeries-at-public-hospitals/GOGLWKMT4EBFTY7PCBYDZ3P4TY/

-

Mussen, D, and Thomas, R. “Desperate Melanoma Patients Forced to Fundraise for Life-Extending Treatment.” Stuff, February 16, 2016. https://www.stuff.co.nz/national/health/76886372/desperate-melanoma-patients-forced-to-fundraise-for-life-extending-treatment

-

“New Zealand Health System.” New Zealand Ministry of Health. https://www.health.govt.nz/new-zealand-health-system

-

“The True Costs of Surgery.” 2019. HealthCarePlus. https://blog.healthcareplus.org.nz/hcp/the-true-costs-of-surgery

-

“Unfunded Drugs and Clinical Trials.” Bowel Cancer New Zealand. https://bowelcancernz.org.nz/about-bowel-cancer/treatment-options/unfunded-drugs-and-clinical-trials/

-

Witton, B. “The Price of a Life: Stark Choice Facing Kiwis Needing Unfunded Medicines.” Stuff, February 16, 2021. https://www.stuff.co.nz/national/health/124171319/the-price-of-a-life-stark-choice-facing-kiwis-needing-unfunded-medicines

ON THIS PAGE

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required