Understanding life insurance in New Zealand: what it is and how it works

Learn all about life insurance - cover, costs, and claims. Discover its importance, how to apply, and factors to consider before deciding.

Life insurance is essential for financial planning. It provides a lump sum payment to beneficiaries upon the insured's death, offering them financial security and peace of mind. This article will explain the purpose of life insurance, what it is, how it works, and why it’s so important.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Learn more on different types of insurance from an expert licenced financial adviser and see what's best for your circumstances.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

What is the definition of life insurance?

Life insurance is a financial product that pays a death benefit to beneficiaries when the insured dies. This protective benefit is referred to as the sum insured of the policy and its value is decided by the policyholder. In exchange for this protection, premiums are paid by the insured to the provider. The benefit can be used for funeral costs, debt repayment, living expenses, and education. Insurance providers have different eligibility requirements based on factors such as age, health, occupation, and hobbies.

Do you need life insurance?

Life insurance is a promise to secure your loved ones' future on death. Here's why it matters:

- Financial security: Life insurance provides a financial backup for your family on death.

- Debt protection: It can help cover debts, rents, and home loans, relieving your loved ones from the burden.

- Income replacement: Helps replace the income of the deceased life assured to enable the family to maintain a similar lifestyle to that if the life assured had continued working until retirement.

- Education support: Ensures your children's education remains uninterrupted, no matter what.

- Funeral costs: Eases the financial strain by covering funeral expenses.

- Peace of mind: Knowing that your loved ones are taken care of even after you're gone offers invaluable peace of mind.

How does life insurance work?

Life insurance is a cost-effective plan offering financial cover for a specific period of time. Policyholders pay fixed premiums throughout, and if they pass away during the term, their beneficiary receives a tax-free death benefit. Life insurance does not accumulate cash value.

Taking out life insurance is an excellent choice for those who want to provide financial security for their loved ones during a specific time, such as when they have dependants or outstanding debts, and to cover the financial loss of a key household earner. There are two sub-types of life insurance offered in New Zealand:

- Level life insurance: A type of life insurance that, according to your chosen sum insured, provides a fixed (‘level’) premium amount for an agreed period of time. It guarantees a consistent payout throughout the term without any decrease in premiums but at a higher cost compared to other policies; and

- Stepped life insurance: A type of life insurance that, according to your chosen sum insured, provides a premium that is recalculated each year based on your age at your policy anniversary, meaning your premium will increase yearly (‘stepped’), but usually starts with lower premiums than level life insurance. There will be a point in the future when stepped premiums cost more than level insurance premiums.

Life insurance cover, benefits, and features

-

Financial security

Life insurance can include cover for funeral costs, outstanding debts, mortgages, rents, living expenses and the overall financial impact of a lost income earner in the household. The amount of cover depends on the policyholder's needs, which therefore determine the type of policy. Benefits of life insurance include peace of mind and financial security for beneficiaries, allowing them to pay off debts, continue living comfortably, and plan for the future.

-

Additional features

Additional features (or ‘benefits’) in life insurance policies, such as accidental death cover, terminal illness cover, critical illness cover, and waiver of premium, may provide extra protection for both the policyholder and their beneficiaries.

-

Covid-19

Because of the Covid-19 outbreak affecting life insurance in New Zealand, some insurance providers have incorporated pandemic-related exclusions in their policies or adjusted their policy wordings for new customers. Check the fine print, ask the provider, or consult an insurance adviser for extra peace of mind.

How much life insurance do you need?

To calculate the right amount of life insurance cover, factors such as income, expenses, dependants, and lifestyle should be considered. Book a 5-minute callback with a Policywise adviser, who can recommend the best life insurance based on your circumstances.

Applying for life insurance

If you are considering applying for life insurance, a deciding factor may be whether your loved ones would face financial difficulties should you die unexpectedly.

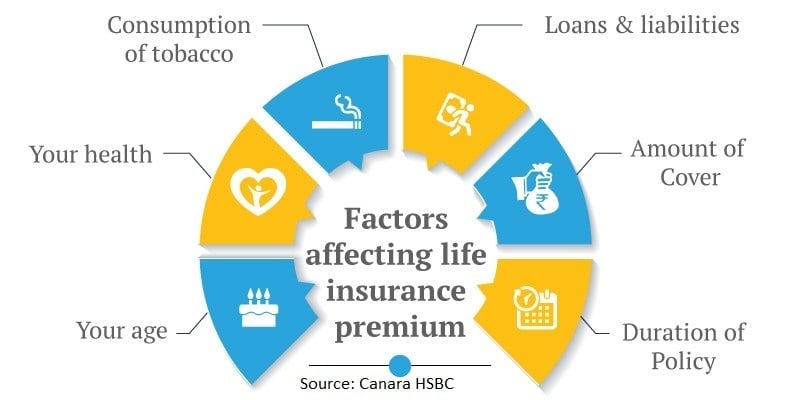

Most people are eligible to apply. Providers will typically ask questions about your age, health, occupation, hobbies, and lifestyle habits to help them assess your risk level and determine your premium. Some providers require evidence of health or medical examinations. Bear in mind that smoking is considered a risk factor and may result in higher policy premiums.

Life insurance applications require different amounts of paperwork, depending on the provider. However, the process is fairly straightforward when applying online - have your medical records, exam results, and accurate information at the ready. The ideal time to apply may vary according to your situation, but in general, younger and healthier applicants have lower premiums.

During the application process, insurers sometimes put extra exclusions or loadings on your cover. This means you may be unable to claim for some pre-existing conditions or you may be asked to pay a premium loading (‘increased premium’). For the greatest likelihood of having to negotiate fewer exclusions and lower premiums, it's important to have an experienced insurance adviser, such as Policywise, by your side to help.

Life insurance cost

The price you pay for life insurance depends on various factors, such as age, gender, health, occupation, smoking status, lifestyle habits, and the amount of cover required. Premiums may increase over time, and payment options usually include monthly, quarterly, semi-annually, and annually. The first premium payment is due when the policy becomes effective, and subsequent instalments are made according to the frequency you choose. Payment options are flexible and can be customised to suit your budget and needs.

Indexation is a feature in most life insurance policies, which automatically increases your cover and premiums (annually) to keep pace with inflation.

Life insurance claims

To make a claim, the policyholder or beneficiaries should contact their insurance provider - or the broker who organised their policy - and complete a claims form with supporting documentation. Once the insurer approves their claim, beneficiaries will receive the lump sum payment. This can be used for any purpose, such as paying off debts, household expenses, or investing for the future.

Some policies may also offer a terminal illness benefit, which provides an early payment if the policyholder is diagnosed with a terminal illness.

Typically, life insurance policies have exclusions, and it’s crucial to read policy documents carefully to understand what’s covered. In New Zealand, life insurance payouts are generally tax-free, but there may be tax implications if the policy is held within an investment vehicle or claimed as an expense through the policyholder’s business. Seeking advice from a tax professional or insurance adviser can help clarify any potential tax implications.

Policywise: your partner in making wise insurance decisions

Policywise is a 100% free service which tells you which health, life, and disability insurance provider best fits your needs. We offer fast, comprehensive, and easy-to-understand comparisons of all leading providers, and a simple summary clearly recommending which insurer is best for your situation.

Not all insurance policies are the same. Policywise can help you sort out the duds, avoid the lemons, understand the fine print and exclusions, and get the right insurance for you and your family.

We make the important decision of where to buy your insurance super easy. We’ll answer your questions, provide experienced advice, quotes, and comparisons, and manage all the back and forth throughout the application process. Taking out your cover through us means you'll have our lifetime support and claims advocacy, and we'll help you negotiate a positive outcome at claim time. We can also take care of lodging any claims on your behalf and back you up if the going gets tough.

Check out the reviews on our homepage for how other New Zealanders have found our service because now is the time to get your life insurance sorted. Give your family or someone you love the most outstanding financial support possible. Book a 5-minute callback with Policywise today; our service is fast and free.

Conclusion

Life insurance is an indispensable tool for providing your family with financial security in the event of your death. Understanding the wording of your policy, the cover amount, and the cost are important considerations. Checking the reputation of insurance companies, comparing policies, and regularly reviewing your policy are also necessary steps. While life insurance may not suit everyone, it can provide peace of mind and protection for your loved ones, making it a valuable investment in their future.

Disclaimer: This article is for general information only. Nothing in this blog or on this website is intended as medical, dietary, or financial advice. Although we aim to update our content regularly, you are advised to consult a Policywise adviser, health professional, or an appropriate specialist before acting on any information herein. They can factor in your personal circumstances or preferences and help guide your decision-making process.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which health or life insurance is best for you.

References

Image Source: Canara HSBC Life Insurance. What is the Meaning of Premium in a Life Insurance Policy? Retrieved 13/03/2023 https://www.canarahsbclife.com/blog/life-insurance/what-is-premium-in-life-insurance.html

Insurance & Financial Services Ombudsman. (n.d.). Life Insurance. Retrieved 13/03/2023 https://www.ifso.nz/information/life-insurance.

Deloitte Limited. (2020). Deloitte Issues Paper: The New Zealand Life Insurance Sector. Key Insights, Trends, Analyses and supplementary commentary on the RBNZ Bulletin (Vol. 83, No. 1.). Retrieved 13/03/2023 https://www2.deloitte.com/content/dam/Deloitte/nz/Documents/financial-services/2020-life-insurance-sector-report.pdf

Forbes Advisor. Danise, A. (2023). What Is Term Life Insurance? Retrieved 24/03/2023 https://www.forbes.com/advisor/life-insurance/choosing-the-right-term-life-insurance/

Forbes Advisor. Huddleston, C. and J, Metz. (2022). Best Tips On How To Get Life Insurance For The First Time. Retrieved 13/03/2023 https://www.forbes.com/advisor/life-insurance/best-tips-first-time-buyers/

Insurance Information Institute. (n.d.). What are the different types of term life insurance policies? Retrieved 24/03/2023 https://www.iii.org/article/what-are-different-types-term-life-insurance-policies

New Zealand Seniors. (nd). How Does Life Insurance Work? Retrieved 13/03/2023 https://www.nzseniors.co.nz/life-insurance/how-does-life-insurance-work

Reserve Bank of New Zealand. Leong, J. and A, Allott. Bulletin: An overview of the life insurance sector in New Zealand (Vol. 83. No. 1). 01 January 2020 (5). Retrieved 13/03/2023 https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/bulletins/2020/rbb2020-83-01.pdf?revision=e6fa6594-53c9-4bc1-bcf8-4ad0c396f9d5

ON THIS PAGE

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required